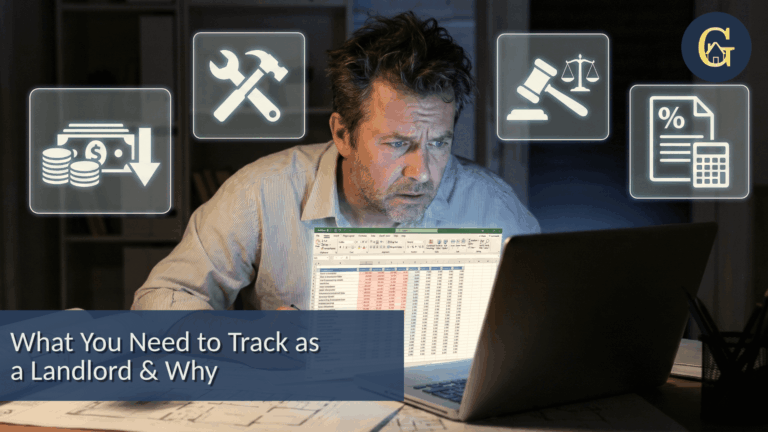

Specialist Accounting for Residential to Commercial Developers

For residential to commercial developers, the opportunity is clear – conversions can unlock higher yields, attract new types of tenants and create long-term investment value. But these projects also bring complex tax implications, financing hurdles and compliance challenges that can eat into profits if not managed strategically.

GoldHouse Accounting works exclusively with property investors and developers, giving you the specialist knowledge and proactive strategies needed to turn conversions into a profitable and scalable model.

Why Residential to Commercial Developers Need Specialist Accounting

Conversion projects often mean navigating both residential and commercial tax rules, understanding VAT implications and structuring your development in a way that’s attractive to lenders and investors. Without specialist advice, you risk paying more tax than necessary, facing unexpected cash flow gaps, or structuring deals inefficiently.

Common challenges for residential to commercial developers:

Managing cash flow cycles from purchase to post-conversion lease-up

Structuring SPVs or holding companies to minimise tax and liability

Planning exit strategies to reduce CGT and Corporation Tax

Extracting profits without triggering unnecessary tax liabilities

How GoldHouse Supports Residential to Commercial Developers

We provide targeted, results-focused accounting and advisory services to ensure your conversion projects are profitable and scalable:

- Tax-Efficient Structuring: SPVs, holding companies, and joint ventures optimised for conversions

- VAT Planning & Recovery: Minimise VAT liabilities and recover eligible amounts on development costs

- Capital Allowances Maximisation: Identify and claim allowances to significantly reduce taxable profits

- Profit Extraction Planning: Strategies including SSAS pensions, dividends, and director loans

- Project Forecasting & Cash Flow Management: Keep developments on time and on budget

- Investor & Lender Reports: Professional, clear financials to secure funding with confidence

- Exit & Long-Term Strategy: Position your portfolio for sustained growth and future conversions

Imagine This…

You complete a residential-to-commercial conversion ahead of schedule, fully tenanted, and with a tax strategy that keeps a significant portion of your profit in your pocket.

Your investors receive timely, professional reports, funding for your next project is secured.

Your financial structure means you’re building long-term wealth while spending more time on strategy and less time worrying about compliance.

This is what smart structuring and property-specific financial strategy unlocks.

Why Work With GoldHouse?

At GoldHouse, we’re not generic accountants who “also” work with property. We’re property specialists, and that means your business benefits from:

Deep Sector Expertise

Years of experience in the property development and investment market.

Proactive Tax Planning

Advice that looks beyond this project to your long-term goals.

Premium, Tailored Support

Bespoke solutions for serious developers ready to scale.

When you work with us, you’re not just keeping your books in order, you’re building a stronger, more profitable property business.