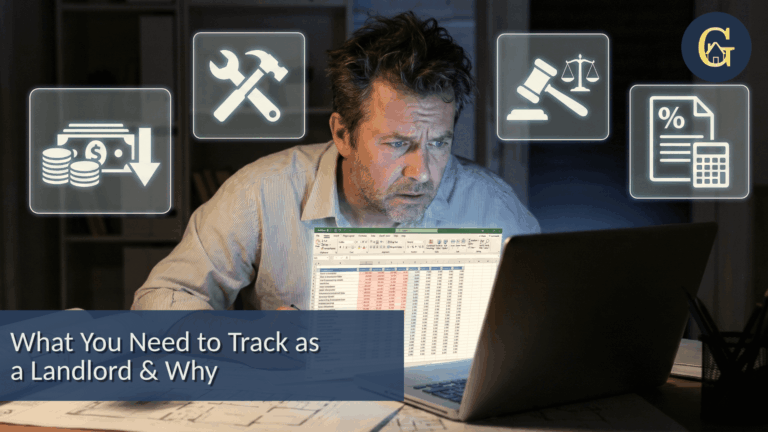

Scaling Portfolios, Protecting Profits

For ambitious property portfolio investors, the challenge isn’t just acquiring properties, it’s managing them strategically to ensure long-term profit and growth. From structuring and compliance to cash flow and tax efficiency, every decision impacts your bottom line.

At GoldHouse, we specialise in helping property portfolio investors scale profitably, protect their wealth and gain complete clarity over their investments.

Why Property Portfolio Investors Need Specialist Accounting

Managing a single buy-to-let is one thing, managing an entire portfolio is another. With multiple properties, investors face added complexity across tax, compliance and financing. A generic accountant may keep you compliant but won’t maximise opportunities to grow your wealth or protect profits.

Common challenges for property portfolio investors include:

Deciding between personal ownership or limited company/SPV structures

Capital Gains Tax (CGT) planning when selling or restructuring properties

Optimising cash flow and profit extraction strategies

Maintaining compliance while scaling portfolios across regions or asset classes

Without specialist support, these complexities can lead to inefficiencies, higher tax exposure and missed opportunities.

How GoldHouse Supports Property Portfolio Investors

GoldHouse provides bespoke, high-level accounting and advisory services tailored to portfolio investors. We don’t just “balance the books” – we build scalable strategies that align with your long-term wealth goals. Our support includes:

- Portfolio structuring advice: SPVs, holding companies, and group structures.

- Advanced tax planning: minimising liability through CGT, SDLT, and VAT strategies.

- Cash flow optimisation: ensuring your portfolio remains profitable and sustainable.

- Profit extraction strategies: maximising retained wealth while drawing income efficiently.

- SSAS pensions and legacy planning: integrating property into retirement and wealth transfer strategies.

- Capital allowances and reliefs: unlocking tax savings on commercial or mixed-use assets.

- End-to-end compliance and reporting: across multiple properties and entities.

Imagine This…

Imagine your property portfolio is structured with maximum efficiency: SPVs set up correctly, CGT liabilities minimised and tax reliefs fully optimised.

Your cash flow is stable, profits are protected, and funding is easier to secure because your accounts are investor-ready.

Instead of chasing paperwork, you have clarity, confidence, and time to focus on your next acquisition, or simply enjoy the financial freedom you’ve built.

This is what smart structuring and property-specific financial strategy unlocks.

Why Work With GoldHouse?

Unlike generic accountants who simply handle compliance, GoldHouse works exclusively with investors and entrepreneurs who are serious about growth.

Here’s why portfolio investors choose us:

Specialist Property Knowledge

We understand the complexities of scaling a portfolio.

Premium, results-driven approach

Focused on protecting profits and maximising opportunities.

Proactive strategy

Not just tick-box compliance, but tailored advisory for long-term wealth.

When you work with GoldHouse, you’re not just compliant – you’re in control, confident and prepared to scale.

Ready to Scale Your Portfolio?

Serious about growing your property portfolio while protecting your profits?